Elderly People Lost Unbelievable $3.1 Billion in Scams in 2022

Elder fraud is on the rise and has an alarming prevalence and devastating impact on victims and their families

The Federal Bureau of Investigation’s Internet Crime Complaint Center (IC3) released its annual report on elder fraud in 2022 last week and the results are significant and alarming.

The IC3 received 88,262 complaints from people over 60 with $3.1 billion in total losses and $35,101 in average loss per victim. 5,465 victims lost more than $100,000. Elderly people experienced an 84% increase in losses compared to the last year. The report also notes that the true number of elder fraud victims is likely much higher, as many cases go unreported.

The report provides insights into the most common types of fraud reported:

Call Center Fraud: the main types of scams are tech and customer support or government impersonation, both are responsible for more than $1 billion in losses. The trends increased by 97% for government impersonation and 147% for tech and customer support scams compared to the last year. The scammers are located in South Asia, mainly in India.

Investment Scams: including advance fee scams, Ponzi schemes, pyramid schemes, market manipulation, real estate fraud, and pig butchering. The last one is responsible for the majority of losses in the investment category. The overall loss in investment scams is $1 billion.

Confidence/Romance Scams: $419 million were lost in this category which includes romance and grandparent scams. The scammers establish trustful and loving relationships and ask to pay for their medical emergencies or legal fees. The grandparent scam alone is responsible for $3,8 million in losses.

Lottery/Sweepstakes/Inheritance Fraud: $70 million was lost in 2022 in these types of fraud. Victims were asked to pay taxes or upfront fees to access their winnings or inheritance.

Non-Delivery Scams: the second most reported fraud type, responsible for over $51 million in losses.

Extortion: including email extortion, hitman schemes, government extortion, and sextortion which is responsible for half of all extortion reports. Victims lost more than $15.5 million in 2022.

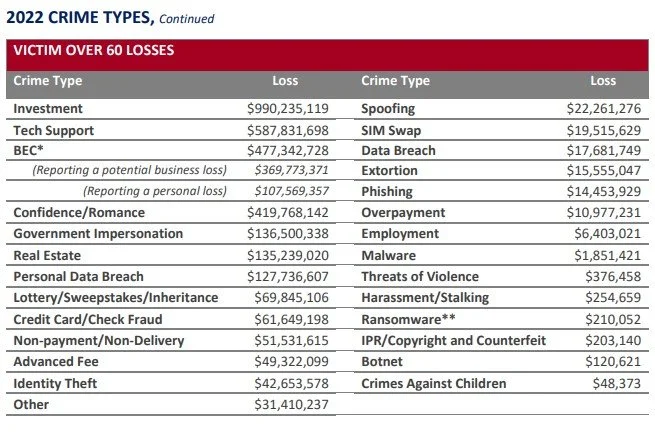

The tables below illustrate the number of specific crime types with victims over 60 and their overall losses:

Cryptocurrency is one of the most common fraud financial vehicles, responsible for $1 billion in losses. 10,000 elderly victims reported losing their money with crypto in investment scams, SIM swaps, call center scams, employment, and romance scams.

The Department of Justice and the FBI are working with law enforcement in South Asia to combat financial crimes affecting elderly people. The report emphasizes the need for increased education and awareness for older adults, as well as enhanced collaboration between law enforcement agencies and financial institutions. Additionally, more effective technologies and tools to detect and prevent elder fraud need to be developed, as well as the enactment of stronger legislation and penalties for those who perpetrate such crimes.

What to Do if You Were Scammed?

Submit reports to these websites:

Interesting Reads This Week: